The Best Guaranteed Investment That Withstands The Market Ups & Downs! Part 2

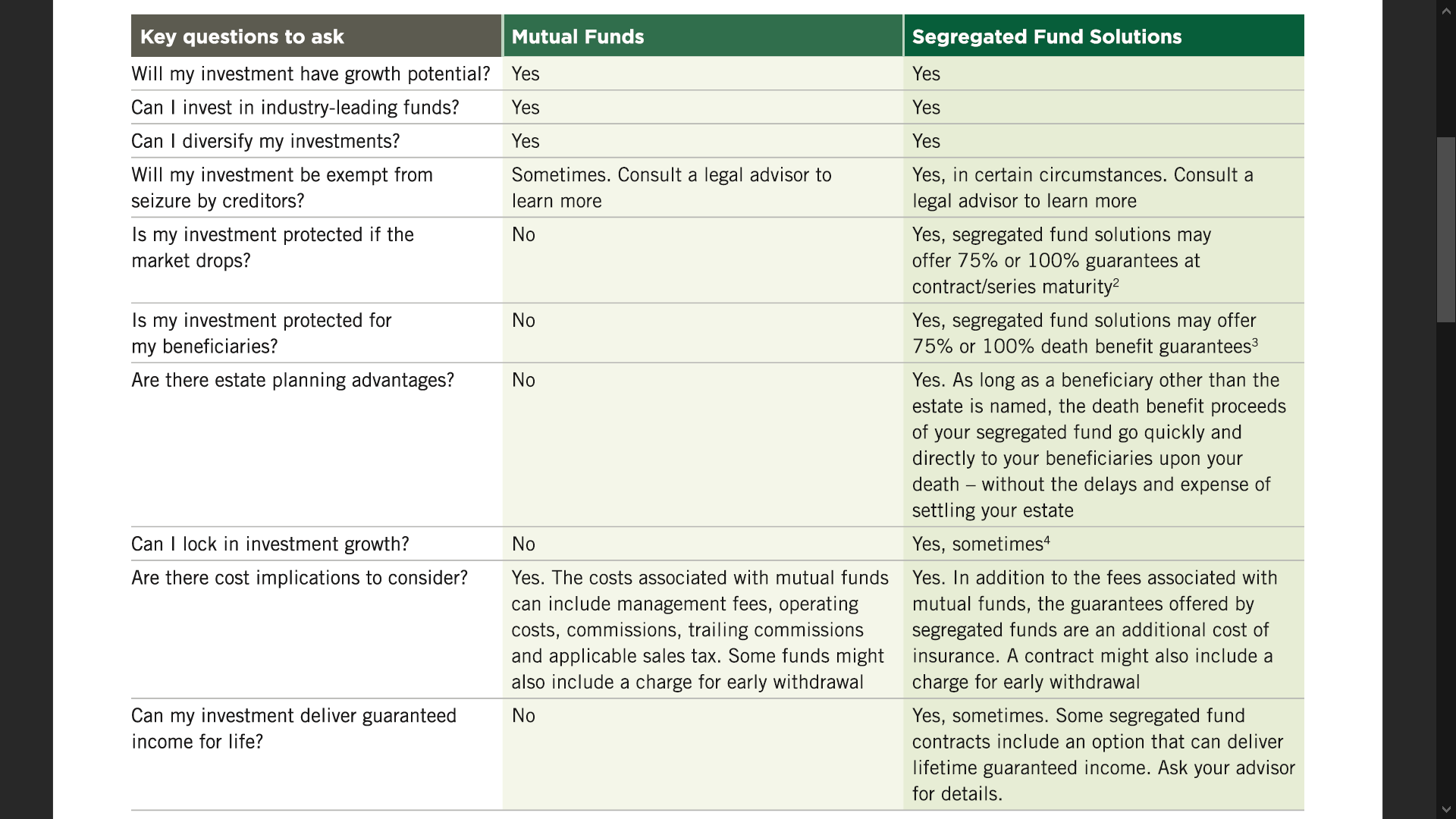

With all these inevitable risks, coupled with the current market condition, it more than ever essential to turn to guarantees and other advantages designed to promote peace of mind. Segregated Fund contracts can be an integral component of a diversified portfolio to ensure that your aspirations and goals for you and your loved ones are achieved with confidence. In addition to access to the growth potential of the markets, investors may take comfort in knowing they can benefit from the following value‑added features:

Maturity Guarantee

At the maturity date, the owner is guaranteed to receive the greater of the market value or the maturity guarantee amount, subject to the provision in the contract or product chosen. This means that in the worst-case circumstance, you’re getting up to 100% of all deposited.

Payout Benefit Guarantee

It guarantees that you get the scheduled income payments provided in the contract, even when the market value is down. In down markets, this guarantee offers additional protection, ensuring that your steady income stream is not interrupted.

Death Benefit Guarantee

Upon the death of the last surviving Annuitant, the beneficiaries will receive a guaranteed amount, the greater of the market value or the Death Benefit Guarantee. The death benefit could be up to 100% of all deposits, less any withdrawals.

Guaranteed Income For Life

Some segregated fund contracts include features that can deliver a guaranteed stream of income for your lifetime or a fixed number of years, as desired. With a guaranteed, predictable income for life, you can be confident that you won’t run of money. Income guaranteed, cannot decrease no matter how the investments perform.

Resets to Lock-in Market Gains

This feature work to capture market growth by allowing the owner to periodically lock-in increases in the market value of their segregated fund contracts. Resets may be automatic or client‑initiated with the assistance of a financial advisor, and may impact the maturity guarantee or Death Benefit Guarantee.

Creditor protection

A segregated fund contract has the potential to protect a client’s assets from creditors. This feature is ideal for professionals and small business owners looking to help protect their personal assets from professional liability.

Estate planning benefits

In addition to guarantees, segregated fund solutions offer your estate planning advantages by helping your loved ones receive an inheritance more quickly and may assist investors to leave more to heirs than they would be able with other types of investment products. Since Segregated funds are insurance contracts, death benefit proceeds pass on quickly and privately to the designated beneficiaries (other than an estate) without any legal, estate administration and probate fees.

Canadians, who are focused on securing a financial future for their family, after they are gone, can rest assured knowing that their loved ones will not endure additional stress during those difficult times.

Other Additional

Potential Creditor P

Assets flowing through an estate (which generally occurs when non‑registered assets paid by financial institutions other than insurance companies) may be subjected to creditors of the deceased, which could mean a smaller inheritance for your heirs.

Privacy & Confidential

Proceeds bypassing the estate and paid to the named beneficiary can preserve confidentiality as the application for probate is a matter of public record. The ability to bypass probate saves your named beneficiaries time and money as well as estate fee upon your death.

Quick & Fast

Settling an estate can be lengthy, frequently taking months or even years should the will be challenged. With a named beneficiary, other than the estate, death benefit proceeds of a segregated fund contract can pass directly to the recipient within a month or two and avoid these delays.

Annuity Settlement Option

This option automatically transfers segregated fund proceeds upon death into an annuity, in accordance with the terms chosen by the client. You also have the opportunity to replace a lump sum death benefit with smaller scheduled payments while providing savings you legal, estate administration and probate fees. It offers additional privacy and potential creditor protection. For heir(s) with poor money management skills or minors, this option comes in handy to spread the inheritance whiles you’re away, at no cost to you!

Want to learn more about Guaranteed Investment Funds and how it can complement your current financial plan, to help you achieve your aspirations and dreams with peace of mind? Connect with us virtually