The Best Guaranteed Investment That Withstands The Market Ups & Downs.

Everyone would all like higher returns on their investments, but few are willing to assume the higher risk usually associated with higher returns. We are aware the markets move up and down, and likewise, we should learn how to factor in the downturn of the market. Unfortunately, volatility is a 2-way street.

People feel confident about their investments in a healthy market. But when the market turns downward, emotions tend to run high. It’s a smart strategy to factor in the downturn phase in our investment plan. This worry has many Canadians looking for investment or retirement vehicles that will not only position their investments for growth when markets are up but also have the potential to protect their capital when markets drop. Any market drops in the years leading up to, or at the retirement stage, can have a devastating impact on a financial future.

Research has shown, not so surprising, that many of us want higher returns than we can achieve with traditional investments like GICs. However, we are uncomfortable or unwilling to assume the risk that can come with those investments that can help us in current investments like mutual funds and stocks.

Today’s investors, like myself, have a simple list of wants when it comes to our money or wealth. They want to :

(a) build and protect their savings,

(b) provide for loved ones

(c) plan for a steady stream of retirement income

(d) retire with confidence and certainty.

An investment product that gives investment choice and the potential for capital growth, the flexibility for diversification and the security of a guaranteed investment is a “Segregated Fund.”

Segregated Funds are most appropriate if you are looking to grow and protect your wealth now and into the future and potentially pass it on to the next generation tax-efficiently.

Segregated fund contracts offer built‑in features designed to help clients achieve peace of mind whiles participating in markets upturns and protecting your capital in downturns. All of these benefits are not possible with other investment vehicles. They appeal to conservative investors, particularly those who worry about market downturns. Over the past few months, I’ve learned that even aggressive investors still have a conservative side to them. Perhaps, you are in this category as well. They have elements that attract business owners and professionals, who may have concerns about creditor protection. They also provide advantages to anyone looking for strategies to protect an estate for loved ones.

Like mutual funds, Segregated Funds are professionally managed and invested in a portfolio of investments. Many segregated funds invest in brand-name mutual funds. But, unlike mutual funds, Segregated Funds are insured investment products. In essence, they are insurance contracts that offer additional benefits such as principal investment guarantees, death benefit guarantees, creditor protection and other estate planning benefits.

Anyone regardless of age, who’s building a nest egg or saving for the future or retirement, can potentially have their savings/ investments negatively impacted by three significant risks:

Market volatility

People feel confident about their investments in a healthy market. But when the market turns downward, emotions tend to run high. Any market drops in the years leading up to, or at the retirement stage, can have a devastating impact on a financial future.

This worry has many Canadians looking for retirement vehicles that will not only position their investments for growth when markets are up but also have the potential to protect their capital when markets drop.

Inflation

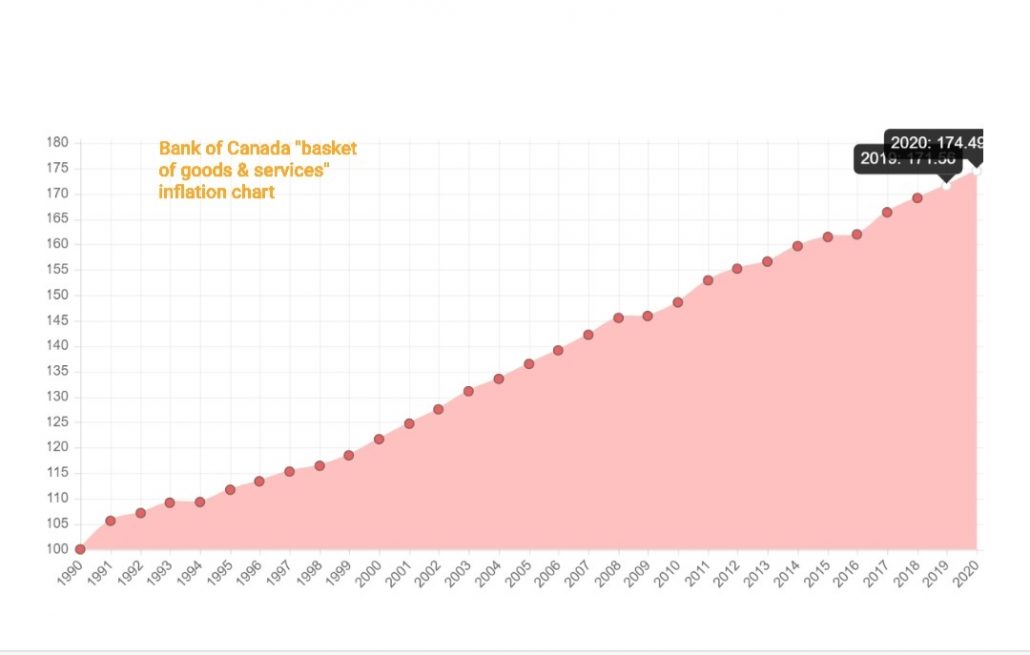

Inflation can undermine your portfolio’s purchasing power over the long term. This chart shows how $100 spent on a “basket of goods & services” in 1990 inflates over time. After 30 years of inflation, the cost increase by over 75%. It’s essential to build a financial plan that offers an opportunity for growth, to minimize the effect of inflation.

Longevity

With the advancement in medical breakthroughs, better health care and safer workplaces, we are living much longer. And this could mean that people retiring today may be looking forward to a retirement of three or more decades – almost as long as the working phase of their lives. And more than ever, it’s essential to have a plan that put together ideas to help build sufficient wealth to provide income for a longer lifetime, especially during retirement.

Look out for the conclusion of the article in my next blog, Part 2…